2023 | Q1 - Artificial Intelligence

“A fool is someone who knows the price of everything and the value of nothing.”

– From the book “Lady Windermere’s Fan” by Oscar Wilde

We focused much of our previous newsletter on the idea that human innovation is the greatest power in the world. The timing was auspicious. News of the latest example of inspired innovation, generative artificial intelligence (AI), specifically, a tool known as ChatGPT, was the biggest story in the first two months of 2023, and for good reason. The stunning advancements on display demonstrate potentially amazing possibilities. ChatGPT’s ability to create original content could ultimately alter entire industries such as health care, finance, and customer service. It has the potential to transform society as we know it and stands as another example of how human ingenuity fuels innovation that can create solutions to the world’s complex problems.

The great irony, however, was that by March, the markets were forced to quickly pivot, from the infinite promise of new, 21st-century technology to the relatively small-scale failings of an archaic, 13th-century innovation – banking. Specifically, the sudden failure of a handful of regional banks, most notably, Silicon Valley Bank (“SVB”), blindsided the markets. Their difficulties were symptomatic of a much more widespread problem – the inability of some investors to adjust to an environment that is no longer artificially stimulated by fiscal and monetary policy. It’s a topic on which we have spilled much ink over the years in previous newsletters. It also demonstrates that while innovation is critical, it’s just as important to be aware of the foundations of investing – price and value.

©Paul Noth / The New Yorker Collection/The Cartoon Bank

An artificial landscape

From 2009 through 2021, in the wake of the financial crisis and in the early months of the COVID-19 pandemic, the investment environment was defined by an “easy money” policy. The Federal Reserve, in response to the 2008 Great Financial Crisis and later the 2020 COVID-19 pandemic, put its emphasis on reflating asset values. This included cutting interest rates to historically low levels and dramatically expanding its balance sheet by purchasing trillions of dollars of securities on the open market, primarily U.S. Treasury debt and mortgage-backed securities. As the market’s largest buyer, the Fed boosted demand for bonds, helping keep interest rates lower in the broader bond market. This artificial stimulus created an excess of liquidity. In such a “rising-tide-lifts-all-boats” environment, every momentum-driven investor looked incredibly smart, what we might call artificially intelligent investors.

Persistently low interest rates led to more money flowing into speculative investments. In the stock market, that led to incredibly expensive valuations for popular stocks, as seen from the perspectives of discounted cash flow analyses, valuation multiples (such as price-to-earnings and price-to-sales ratios), and bloated balance sheets. It went beyond the stock market, to newly created investment vehicles such as cryptocurrency and non-fungible tokens (NFTs). Investors were deluded into thinking that essential investment considerations like valuation and risk no longer applied; that simply joining the herd and relying on passive approaches like index funds would deliver desired, long-term results; and that the extreme approaches that appeared to work for a time represented a sustainable strategy.

How much liquidity was injected into the markets? The Federal Reserve’s balance sheet rose from less than $1 trillion in 2007 to nearly $9 trillion by March, 2022. Another indicator of the amount of liquidity in the market was the explosion of the M-2 money supply. This represents all cash people have on hand plus deposits in checking and savings accounts and CDs. The M-2 stood at $7.3 trillion in July 2007. By March, 2022, it nearly tripled to $21.7 trillion. 1

This is important, because in a world of excess liquidity, markets fail to properly price risk. As a result, investors fueled a surge of momentum-based trading that, prior to 2022, drove the price of many growth stocks, primarily big tech names, into the stratosphere.

A return to reality

Silicon Valley Bank’s downfall appears to be primarily due to a reckless style of investing that ran rampant during the free money era. Excess liquidity helped SVB quickly accumulate billions of dollars in deposits. SVB opted to put much of the money to work in the bond market. Unfortunately, they invested at a “top,” with interest rates near all-time lows. What’s worse, they tried to squeeze every dollar of income that they could by investing in long-term bonds that added significant duration risk, but only generated marginally higher yields. As any well-trained investor knows, the longer a bond’s duration, the greater the interest rate risk. Once rates moved higher, SVB’s bond holdings fell significantly in price (as bond prices and interest rates move in opposite directions). This set off a chain reaction of events that led to SVB’s collapse.

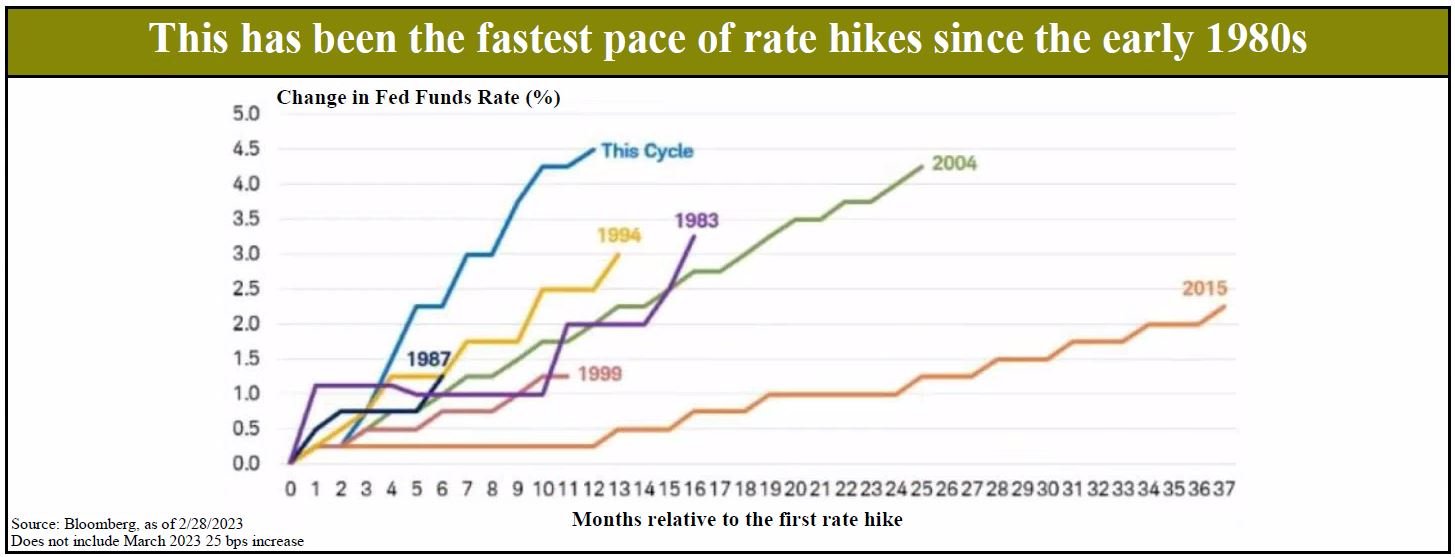

SVB and many other investors ran into trouble beginning early last year when the Fed dropped the hammer and upset the markets’ status quo. From March 2022 forward, it raised its federal funds target rate from its long-held zero-bound level to a range of 4.75% to 5.00%, the fastest rate-hiking regimen in history. This included another rate hike in March 2023, even as markets faced turmoil amid concerns about the impact of SVB’s collapse. At the same time, the Fed is taking liquidity out of the system by reducing its balance sheet for the first time in years. It has accomplished this by not purchasing new securities to replace maturing bonds. These actions were inevitable with inflation’s resurgence, and the Fed clearly signaled that change was coming. Even so, many fixed-income and equity investors appeared to be caught off guard as they face the harsh reality that the strategies that worked since 2009 were no longer applicable in a normalizing interest rate environment.

Diverting from the crowd

We were not among those in the investment community surprised by this turn of events. As readers of our newsletter know, we’ve been writing about the inevitable change in the interest rate environment for some time. Investors who refused to get caught up in the frenzied environment that dominated the market until early 2022 managed to sidestep many of the devastating losses seen in the frothier parts of the market. We don’t pretend to have all the answers. But unlike many, we did anticipate that, given the basic laws of finance and economics, the turnaround in interest rates had to happen. Notable and outspoken investor, Carl Icahn sums it up well – “Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.”

Markets constantly reprice investment risks and opportunities. This fact was overlooked by those displaying artificial investment intelligence, who mostly followed the crowd and paid too high a price for the comfort of investing in popular assets – whether they were expensive growth stocks or deceptively “safe” bonds. These investors seemed to forget the simple fact that markets, by their nature, change course and that a good, long-term investment strategy must be designed to weather those changes. The bottom line is that the “smart” money of the 2010s and early 2020s doesn’t look so smart anymore. Price and value have re-emerged as essential factors in the investment process.

At the outset of 2023, we see many investors following a familiar pattern, betting that the biggest technology stocks still represent “safe havens,” even though interest rates have risen significantly, and inflation remains elevated. This again shows an inability to appreciate the dramatic changes in the underlying economy over the past 18 months. With a return to normalized interest rates and reduced liquidity in the financial system, the artificial stimulus is dissipating. This creates a less hospitable environment for growth stocks whose prices are based on projected earnings far into the future, rather than actual fundamentals that exist today.

Too many investors, overwhelmed by the one-sided markets of the previous decade, lost their discipline and their ability to see the bigger picture of a changed environment. Even many professional investors who normally focused on value, caved in and compromised their standards, sacrificing their long-term vision for short-term gain. They seem to have forgotten the importance of assessing value when determining a stock’s appropriate price, as well as its risk.

©Lee Lorenz / The New Yorker Collection/The Cartoon Bank

Watching a game of musical chairs

We’ve fought tooth and nail against a barrage of pressures to conform with the hordes that have put money to work in overpriced segments of the stock and bond markets. As these speculative investments continued to appreciate absent supporting fundamentals (the textbook definition of a bubble), stocks in which we were invested – great businesses purchased at attractive valuations – weren’t the primary beneficiaries of the pre-2022 market surge. We were not deterred. We were, and remain, steadfast in our discipline and unwillingness to overpay and take on excessive risk to keep up with popular market trends. Our approach had a dampening, short-term impact on our portfolio’s comparative performance during the time when momentum stocks and most types of bonds thrived. However, the longer the momentum carried on, the bigger the bubble became. It was like a game of musical chairs. Over the past year, we’ve seen, one-by-one, inflated, speculative assets suffer huge setbacks. Silicon Valley Bank was yet another example of an institution caught standing when the music stopped.

We now know that the artificial intelligence that led to the growth stock boom of the 2010s and early 2020s is out of place in today’s market. Instead, investors must be aware that risk is a reality of investing. Focusing on the price paid for an investment is critical. Overpaying is no longer forgiven. And unlike large institutions, individual investors can’t count on a government bailout to overcome poor investment judgment.

The story doesn’t stop at a discussion about risk. We are excited by the vast opportunities the market presents us today. We firmly believe investors who entrust their hard-earned money with a professional manager need to be assured that their manager will be vigilant and steadfast, even in the face of short-term events that run contrary to their investment discipline. When it comes to helping our clients achieve and protect wealth without taking inappropriate risks, we never strayed. Now, we find ourselves in a position with fewer competitors, focused on the incredible values that offer truly great potential for the long run.

As we search for those values, innovation remains a key consideration. It goes well beyond the latest developments in artificial intelligence that we spoke of at the outset of this newsletter. Innovation is everywhere – from traditional sectors like information technology and medical devices – to almost every other industry – such as agricultural production and consumer services. Successful implementation of innovative technologies and concepts is a critical component to long-term wealth creation, particularly for investors who pay the right price to participate.

~MPMG

1 Board of Governors of the Federal Reserve System, as published by Federal Reserve Bank of St. Louis.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.