About

MPMG is a value-based investment management firm that actively manages separate accounts for individuals, families, trusts, retirement funds, endowment and foundations, and institutions. We are an owner-operated company. We are a research-driven firm that selects individual stock investments and manages the portfolios for our clients. We do not sell mutual funds, insurance, annuities, index funds, ETFs, or other products. We are not a middleman or broker for other managers. We are the money managers.

We believe…

Investing serious money is a serious venture.

Legendary value investor Benjamin Graham was correct - “The investor’s chief problem – and even his worst enemy– is likely to be himself.”

Providing individuals with the freedom to make their own investments often leads to harmful knee jerk reactions instead of steady progress.

Having the expertise and methodology to value a business is ultimately what drives results.

The best businesses can be a bad investment if you pay too much for them.

The secret sauce to investing is patience and discipline.

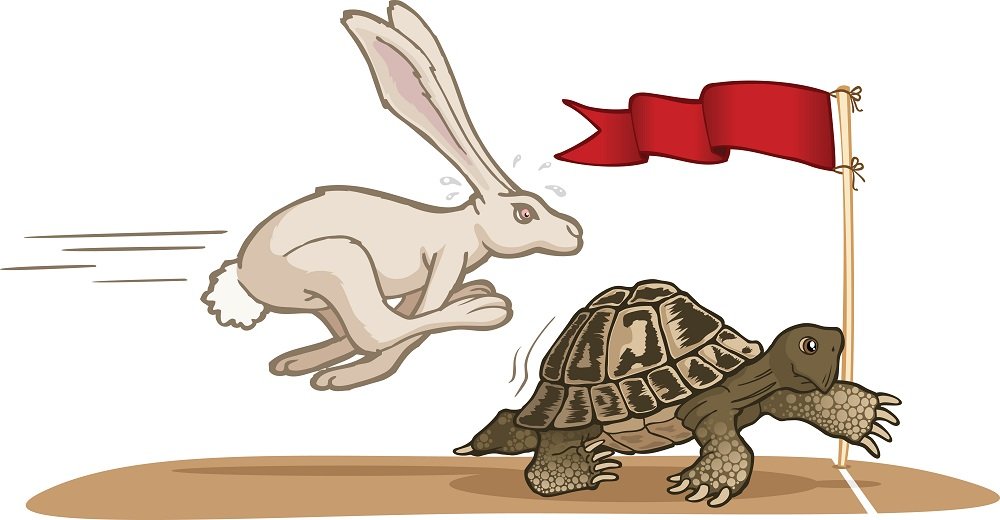

The significance of the tortoise as our logo.

The Tortoise & The Hare has always been a profound story for us. The swift Hare is fast out of the gate but decides to take a nap along the way as he becomes tired. On the other hand, the slow and steady Tortoise just keeps plodding along and ultimately wins the race.

It takes patience and discipline to create wealth so we feel that the tortoise is a perfect metaphor for what we’re trying to do for our clients.

The slow and steady investor who avoids the popular manias and emotional swings of the market, and just buys good business at good prices will too eventually win the race!

PRIVACY POLICY

Minneapolis Portfolio Management Group, LLC (“MPMG”) has adopted the following privacy policy in order to safeguard the nonpublic personal information of MPMG’s clients in accordance with applicable law:

(1) MPMG is committed to protecting the confidentiality and security of the information it collects and will handle nonpublic personal information about clients only in accordance with all applicable laws, rules and regulations. MPMG will seek to ensure: (a) the security and confidentiality of client records and information; (b) that client records and information are protected from any anticipated threats and hazards; and (c) that unauthorized access to, or use of, client records or information is protected against.

(2) MPMG will maintain policies and procedures that are reasonably designed to safeguard nonpublic personal information about clients and only permit appropriate and authorized access to, and use of, nonpublic personal information about clients through the application of appropriate administrative, technical and physical protections.

(3) MPMG will not disclose any nonpublic personal information about its clients or former clients to anyone, except as permitted or required by law.

(4) MPMG will issue notices of its privacy policy to its clients initially and on an annual basis thereafter to the extent required by applicable law or contractual provisions, whichever is more restrictive.

Subject to the exceptions noted below, MPMG will not divulge to third parties nonpublic personal information, including its portfolio holdings, specific trading strategies or pending transactions. MPMG will also take suitable security measures, including maintaining client files in locked drawers and requiring passwords to access systems containing client data.

MPMG may disclose portfolio holdings, specific trading strategies, pending transactions or other information not generally available to the public to those service providers of MPMG who need such information in the normal course to provide their services.

MPMG will require that any such service providers acknowledge their duties of confidentiality and care with respect to nonpublic personal information concerning MPMG’s clients, represent that they have taken reasonable steps to safeguard such information, and represent that no service provider employee or other representative who possesses such information about MPMG will transact in any securities or other instruments based on, or otherwise misuse or pass along, such information.

In all other cases, MPMG may be permitted to disclose portfolio holdings, specific trading strategies, pending transactions or other information not generally available to the public. Generally, employees should discuss any such disclosure and obtain advance approval from MPMG’s Chief Compliance Officer.

PERFORMANCE DISCLOSURE

Firm: Minneapolis Portfolio Management Group, LLC (“MPMG”) was incorporated in December 2003 and began operating in 2004. MPMG is an independent investment adviser registered with the United States Securities and Exchange Commission that invests in both domestic and international small-, mid-, and large-cap equity securities. Policies for valuing investments, calculating performance, and preparing GIPS reports are available upon request.

The All Cap Value Composite (“ACV Composite”) utilized by MPMG was created and incepted on January 1, 1995 by MPMG’s founder, Phillip Grodnick, while associated with Salomon Smith Barney, Inc. Data from January of 1995 through March of 2000 represents the performance of accounts managed by Phillip Grodnick while associated with Salomon Smith Barney, Inc. Data from April of 2000 through March of 2004 represents accounts managed by Phillip and Harrison Grodnick while associated with Wachovia Securities, LLC. Data from April 2004 through June 2011 represents accounts managed by Phillip and Harrison Grodnick at MPMG. Rob Britton joined MPMG as a portfolio manager in July 2011. These results reflect the performance of all accounts under management for at least one calendar quarter that have been managed during the times listed above on a discretionary basis, using the same strategy.

Calculation Methodology: Returns for periods longer than one year are annualized. Results are size and time-weighted and net of expenses, excluding the effect of all income taxes, and unless otherwise noted, reflect reinvestment of interest, income, and/or realized capital gains. All realized and unrealized capital gains, losses, dividends and interest from investments and cash balances are included. The composite is asset-weighted, using end of quarter market value. Dispersion is presented as the standard deviation of the individual component portfolio returns around the aggregate composite return on an asset weighted basis. The results are expressed in U.S. Dollars. Because MPMG’s accounts are individually managed and clients may impose restrictions on management, account performance may vary.

Benchmark: A benchmark of 100% of the S&P 500 Index has been calculated. The S&P 500 Index contains 500 U.S. industrial, transportation, utility and financial companies. It is capitalization-weighted calculated on a total return basis with dividends reinvested. The NYSE Composite Index (Symbol: NYA) is a measure of the changes in aggregate market value of approximately 2,000 NYSE-listed U.S. and non-U.S. stocks, adjusted to eliminate the effects of capitalization changes, new listings and delisting’s. It is weighted using free-float market capitalization, and calculated on both price and total return basis. The Russell 3000 Value Index is a market-capitalization weighted equity index maintained by the Russell Investment Group and based on the Russell 3000 Index, which measures how U.S. stocks in the equity value segment perform. Included in the Russell 3000 Value Index are stocks from the Russell 3000 Index with lower price-to-book ratios and lower expected growth rates

Selection Criteria: The ACV Composite includes all discretionary accounts with no client-imposed restrictions that are managed in accordance with the ACV Composite strategy. Performance data for all accounts has been calculated from each account’s first full quarter of management through the date of this report or the last full quarter of management prior to cessation of the account.

Composites: Additional information regarding MPMG’s policies for calculating performance results, including a complete list and description of all MPMG composites and performance results, is available upon request.

Fees: The performance results are shown net of actual fees from 3Q 2004 - present, a 2% model fee for 2Q 2000-3Q 2004, and a 2.2% model fee for 1995-1Q 2000. Model fees represent the highest fee charged to any account managed by MPMG while associated with Salomon Smith Barney and, subsequently, Wachovia Securities, LLC. Investment advisory fees may vary significantly from client to client. MPMG’s investment advisory fees begin at 2%, and may decline based on factors such as (but not limited to) the amount of assets under management, the nature of the assets, the type of analysis required to manage the account, the level of service required by the client and the overall relationship of the client with MPMG. The fees charged for wrap programs typically include investment management fees, transaction costs and, in some cases, custody fees.

Since no one investment program is suitable for all types of investors, this information is provided for informational purposes only. Past performance is not a guarantee of future results. You should review your investment objectives, risk tolerance and liquidity needs before selecting a suitable investment program.