2022 | Q1 - The Fog of War

“In the midst of chaos, there is also opportunity.”

- Sun Tzu, legendary Chinese military general and philosopher

The world has been upended by Russia’s military invasion of Ukraine. As the most significant land war in Europe since World War II plays out before our eyes, it gives us a first-hand look at the strategic and moral vagaries often referred to as “the fog of war.” While this phrase is typically used in military terms, today it has a much broader application beyond the battlefields of Eastern Europe, even reaching the capital markets.

As with most unanticipated events, markets reacted negatively to the onset of the war. An indiscriminate market selloff occurred that temporarily sidetracked the momentous shift that had begun only months earlier. As the fog of war settled in over the markets in late February, it put a temporary hold on what we’ve long described as an inevitable trend that will be the dominant theme in the markets in the next stage of the economic cycle – the rotation out of overpriced growth stocks and into underappreciated value stocks.

©David Sipress / The New Yorker Collection/The Cartoon Bank

Where we were before the war

We’ve spilled a lot of ink over the years writing about an unprecedented period of what can be described as an era of “free money” washing over the economy and the markets. This has been the defining factor affecting asset valuations going as far back as the financial crisis of 2008. The collapse of the markets at that time led to a spectacular deflation of asset value. The Federal Reserve (the Fed) took aggressive measures to “re-flate” those depressed assets. The tactic they employed was providing “free money” by artificially suppressing interest rates and purchasing bonds to help add liquidity to the system. The re-flation tactic was critical to helping the global economy move past the financial crisis, but it didn’t end there. The Fed has maintained a highly accommodative stance (low interest rates, an expanding balance sheet) throughout most of the last 10-12 years.

The consequences of the “free money” era were far reaching. Most notable is that it fueled an extended period of highly-speculative trading in the stock market. Investors responded to the fact that borrowing costs were negligible, and cash and fixed income instruments offered little in the way of competitive returns. In addition, low interest rates supported soaring stock prices for companies with modest earnings. That’s because interest rates are part of the calculation for the present value of future earnings. The lower the interest rate in the calculation, the higher the assumed present value of future earnings, which prompts investors to feel more justified in bidding up the prices of some stocks.

This worked to the benefit of growth stocks, particularly a narrow group of “celebrity technology stocks.” They benefited from investors pricing their shares at levels that were unreasonable based on current earnings, but were perceived to be reasonable as a reflection of projected future earnings growth. Keep in mind, those projections relied on interest rates remaining near historically low levels. There was never much chance that interest rates would remain at the historically low levels they reached in the past two years.

The pandemic created additional “free money” that poured from the coffers of the federal government and into the pockets of taxpayers, businesses and local and state governments. In combination with the Fed continuing to put its thumb on the scale, the economy was rife with money. As a result, the “risk” aspect of the risk/reward equation was obscured.

Yet as we’ve stated in past newsletters, over the long term, the free money strategy is unsustainable. The reality on the ground today validates this belief.

The era of “free money” is over

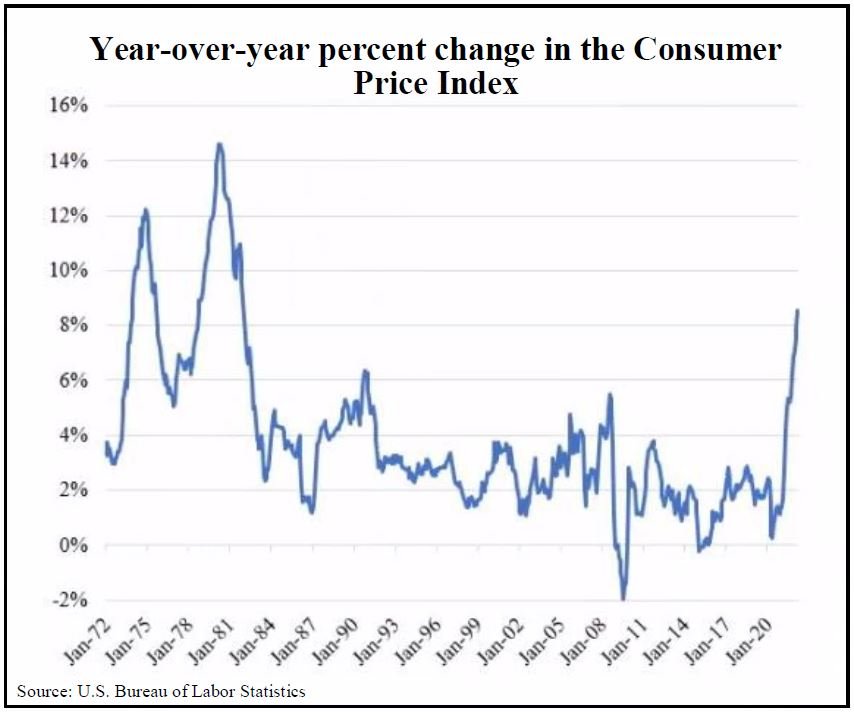

We may never see the likes of this free money bonanza again. Inflation has re-emerged in a serious way for the first time in 40 years, forcing the Fed to drastically alter its easy money policy. This has occurred in two major ways. First, the Fed ended its nearly two-year long program of injecting money into the bond markets, and is likely to start reducing the $9 trillion balance sheet, most of that accumulating since 2008. Second, the Fed also began to raise short-term interest rates (the federal funds rate), with Fed Chairman Jerome Powell insisting they will continue to do so aggressively until the inflation dragon is slain. The Russia-Ukraine conflict may force the Fed to push interest rates higher because prices for energy, wheat and other commodities are likely to be elevated, given that both countries are major producers and exporters.

This strategy was both beginning to be laid out by the Fed, and anticipated by the markets in the closing months of 2021. It was then that investors who paid attention to fundamental measures like valuation, cash flow, and profit and revenue acceleration, were finally rewarded as stocks with such pertinent characteristics outperformed the broader market. At the same time, the celebrity technology stocks with outsized earnings expectations suggested by their lofty prices, struggled mightily. We were in the early stages the long-anticipated rotation out of growth stocks and into value stocks – a powerful trend we’ve discussed in recent newsletters. This significant market shift is expected to continue for an extended period of time.

Headlines usurp fundamentals…temporarily

Unfortunately, the fog of war suddenly obscured the market fundamentals that typically drive stock market performance. This is understandable given the shocking developments in Eastern Europe. The uncertainty created by the bloody conflict caused a sharp selloff that hit many of the overvalued parts of the market the hardest. Ultimately, both the Dow Jones Industrial Average and the S&P 500, benchmarks of large-cap stock performance, fell into “correction” territory, with declines of more than ten percent. The technology-driven NASDAQ Composite Index dipped into “bear market” territory, with a drop surpassing 20% from its peak. Notably, many of the red hot FAANG+ stocks1 we talked about in past newsletters, which make up 25% of the S&P 500, declined even further.

The fundamental economic changes that so profoundly affected capital markets before the fog of war set in haven’t suddenly disappeared. If anything, the inflation threat is exacerbated by risk of commodity price spikes mentioned above. Inflation is likely to remain at elevated levels for longer than many initially anticipated. The Consumer Price Index, the most visible measure of inflation, was up 8.5% for the 12 months ending in March.2 We’ve seen nothing like that in 40 years. Despite the market’s indiscriminate reactions to the war, the reality is that the conflict contributes to the underlying conditions that have driven the shift in the markets and the end of the free money era.

The facts on the ground

The fog of war may be obscuring many of the positive developments that investors should find encouraging. The U.S. economy is coming off its strongest year of growth in four decades.3 The unemployment rate is nearly at pre-pandemic levels.2 Americans appear to be in a strong financial position, sitting on $2.6 trillion in extra savings – equal to roughly half of the pandemic-driven stimulus relief that was paid to most Americans.4 This is important, because consumer spending typically makes up about two-thirds of the nation’s economic activity.

The economy may not match 2021’s rapid rate of growth, but if GDP comes in at half of the pace it achieved last year, it will still rank as the strongest year of economic activity in all but two years dating back to 2005.4 The economy’s current strength may help the Fed achieve a “soft landing” (meaning slower growth, but no recession) as it seeks to temper the inflation threat.

What isn’t talked about in the news

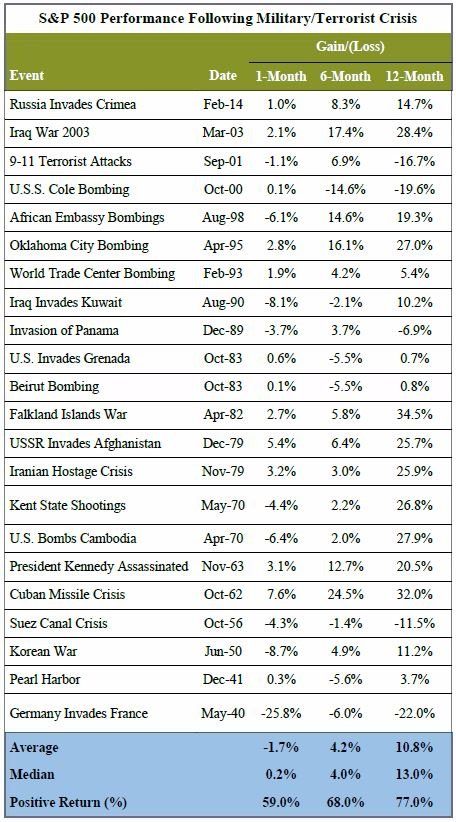

Investors should not assume that the existence of a brutal war is a harbinger of negative prospects for the investment markets. In spite of the foggy conditions that war creates, the historical performance of the stock market in such times is solid. Stocks often generate a positive track record in the year following the start of major military incursions. Since World War II, during periods of military turmoil, stock markets gained ground at least 80 percent of the time. The average return one year after the beginning of a conflict was nearly 11%.

This is evidence that war, in and of itself, is not likely to turn the markets. While we await the next phases of the war, economies in most parts of the world continue to function. Companies continue to operate, innovate, and create wealth. From our perspective, the mostly indiscriminate and headline driven sell-offs have created opportunity for selective investors looking for bargains.

Meet the new boss – same as the old boss

It wasn’t long ago when investor complacency ruled the day, as money flowed into the same few stocks (see FAANG+ above), driving their prices ever higher. This led to a historical disconnect between the prices of growth and value stocks. It also belied a much more significant historical trend – that over longer periods of time, value stocks outpace growth stocks. This is less about how value performs during boom times than how it withstands the market’s more challenging periods. Value stocks tend to limit losses in down markets, while growth stocks have historically been susceptible to more dramatic declines during those same periods.

©Christopher Weyant / The New Yorker Collection/The Cartoon Bank

We are in the early stages of a period where the underlying economic environment is changing. There’s more uncertainty about what’s next for the economy, and many investors feel more anxious than they did in the time when “free money” stimulated unsustainable growth.

Periods of volatility can do a lot to change an investor’s perspective. The “risk” side of the risk-reward spectrum is back on their radar. Investors are gaining a better appreciation of the benefits of prioritizing fundamental value to minimize the long-term impact of market volatility and position their portfolios for future growth. Our approach was rewarded in the months leading up to the war, and the inexorable trend will likely resume.

Geopolitical developments may continue to dominate the headlines in the short run. Yet in the end, fundamental factors uncorrelated to today’s dominant news will truly drive the markets. Individual measures that define a stock’s potential – sales growth, increasing cash flows, higher margins, reduced debt, stock buybacks – will be the determinants of investment opportunity in 2022 and beyond. While the fog of war in Ukraine has been devastating, it will not be the ultimate driver of long-term investment returns… although it seems that way at the moment. Ultimately, fundamentals will prevail. We believe that we are in the early stages of an extended “stock picker’s market.” In this environment, the price that you pay for an asset, and not headlines, will be the primary determinant of investor success.

~MPMG

1 These stocks consist of Facebook, Amazon, Apple, Netflix, Google (Alphabet) and Microsoft.

2 Source: U.S. Bureau of Labor Statistics.

3 Source: U.S. Bureau of Economic Analysis.

4 Van Dam, Andrew, “Two years into the pandemic, America has become the land of the bulging bank accounts,” Washington Post, Feb. 23, 2022.

5 Federal Open Market Committee, Projections materials, March 16, 2022.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.