2021 | Q1 - “Shall We Play a Game?”

“Mr. McKittrick, after very careful consideration, sir, I’ve come to the conclusion that your new defense system stinks.”

- a slightly paraphrased line from the 1983 film, WarGames

The headline of this newsletter is a signature statement delivered by a supercomputer from the classic early 1980s movie, WarGames, starring a young Matthew Broderick (well before his Ferris Bueller days). It was a film that arrived at the intersection of the Cold War and the technological revolution. In it, Broderick plays a computer-savvy teen – back in the days of floppy disk drives and dot-matrix printers. Obsessed with playing computer games, the young hacker believes he has tapped into the system of a gaming company, when in reality, he is playing a simulation on a U.S. Department of Defense mainframe computer (with the fun acronym WOPR, for War Operations Plan Response). This system happens to control nuclear missile launches for the United States. The simulation being run is one of the most frightening “games” of all – global thermonuclear war. The problem is that as the computer plays out the simulation, it sends signals that could ultimately launch missiles and hurtle the world toward Armageddon. With no way for humans to manually override the computer, the crafty teenager ultimately tricks the machine to teach itself about the reality of a game of global thermonuclear war. The computer comes to the conclusion that “the only winning move is not to play.”

Side Note: After watching WarGames, President Ronald Reagan asked his Joint Chiefs of Staff if a scenario like that depicted in the movie could occur in the real world. The response he received was “the problem is much worse than you think.”

Today’s real life WarGames

Just like in the movie WarGames, investors can sometimes participate in dangerous activities that they mistake for entertainment. It seems lately that many of them lack an understanding of the seriousness of their actions. Investing is not a game, and poor decisions can have “nuclear” consequences. For these game-players, there has been no shortage of faddish investments into which they can direct their misguided money.

Much has been made of the “Reddit Revolution,” with social media posts driving activity in specific, deeply out-of-favor stocks, like that of struggling video game retailer GameStop. As small investors drove up the stock’s price, short sellers were forced to become buyers to cover their short positions. In a matter of weeks, there was a 1,700% jump in the stock’s price before it fell back to earth. Billions of dollars have found their way into SPACs – Special Purchase Acquisition Companies – essentially a way to entice investors to write blank checks so that SPAC management can later choose companies to acquire to try to win a payoff. Other investors are chasing a high in emerging stocks from the marijuana industry, hoping to find serious green in the current wave of state-sanctioned weed. The crypto currency phenomenon is still a thing. Bitcoin’s price has surged recently, a scenario we’ve seen before in its short, but volatile, history. Sports trading cards have experienced a dramatic revival, with a Tom Brady rookie card selling for an astounding $1.3 million. The most difficult of these crazes to grasp, literally, is the burgeoning market for NFT’s – Non-Fungible Tokens. A piece of digital artwork by a previously obscure and lightly-regarded artist known as Beeple, sold at auction for nearly $70 million.

In many cases, we’re talking about people chasing a shiny object looking to make their quick buck and perhaps get a bit of a rush from it in the process. Yet, as an investment strategy, we would borrow from the quote posted below this newsletter’s headline – after very careful consideration, we’ve come to the conclusion that these ideas, as wealth creation strategies, stink.

©Michael Crawford/New Yorker

Defense wins championships

You don’t have to be a gambler to get rich in the stock market. You do need to pay attention to price, the quality of the business, and the strength of the company’s balance sheet. You also need to demonstrate an abundance of patience as you await what could be your generous reward.

The great irony of the rabid speculative activity we’ve just outlined is the timing of it all. It occurs just as the economy is poised to lay the foundation for investment success in the most traditional segments of the market.

Amidst this strong foundation, what many are overlooking is the most successful investment approach in the history of the markets – value investing. It is an investment style that recognizes the reality that good businesses often encounter challenging periods where earnings may be unimpressive compared to those of other companies. It is at times like these that such stocks may fall out of favor. This represents a real opportunity to invest in companies that are well positioned for the long run, provided you have the patience to see through their challenges. This is in sharp contrast to choosing speculative investments at excessive prices that will be hard pressed to live up to the lofty expectations that have been set by the market. We’ve pointed out prime examples of this in the past, like Cisco and Corning. Both are thriving businesses that will play an instrumental role in shaping our promising future. Yet despite enjoying robust growth, these stocks are not immune to the consequences of the aftershocks of a market mania. Their prices reached a peak during the dot-com craze in 1999 and 2000, but even more than 20 years later, have yet to scale those same heights. There are likely more investments in today’s market positioned to sap wealth from investors.

It is hardly a coincidence that all of the activities involving the newest, “hot” assets like SPACs and trading cards comes on the heels of record fiscal and monetary stimulus. We’ve seen it happen before – periods when investors jumped on similar bandwagons with little consideration to the price they paid or the value they received. In hindsight, it is easy to understand the appeal of such speculative choices and why they rarely live up to expectations. Yet too many investors are continuously caught off guard as they misread the signals in the moments leading up to a major turn in the market for these exotic investments. In many cases, factors like Federal Reserve interest rate hikes play a role in altering the market environment. Today, there are clear signs that a rotation has begun. Money is moving out of more speculative segments of the market and into investments that offer true value based on more realistic expectations. This is evidence of more astute investors recognizing the importance of positioning not for the moment, but for what comes next.

The missing headline

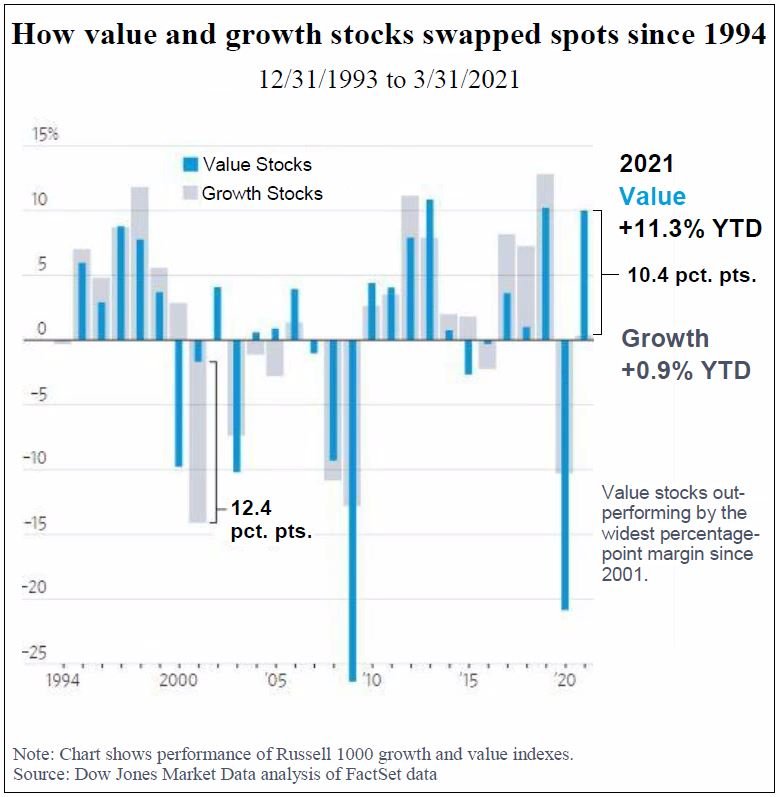

While GameStop and Beeple took up much of the media’s oxygen, the overlooked story of recent times is the dramatic rotation into value stocks. In the first quarter, the Russell 1000 Value Index outperformed its counterpart Growth Index by 10.4 percentage points. It was by far the largest first quarter advantage for value stocks in 20 years.

If history is any indication, this could be a sign that a long-awaited era of leadership for value stocks is upon us. In 2001, after kicking off the year with a major advantage for growth stocks, value maintained the trend for a full six years. Yet from about 2009 on, growth has enjoyed the upper hand. Notably, the first three months of 2021 marked the second consecutive quarter of value stocks outpacing growth stocks. In the 4th quarter of 2020, value stocks enjoyed about a five-percentage point advantage. We may be on the leading edge of a sustained renaissance for value stocks. Underlying economic developments support this expectation.

Economic trends lean toward value

We’ve suffered through an extended period of steady but muted economic growth. Consider that in four consecutive years, from 1997 to 2000, Gross Domestic Product (GDP) growth topped 4% each year. It hasn’t happened since. Over the past 20 years, GDP increased by an average of just 1.7% per year.1 With such tepid economic performance, investors looked to invest in companies with an ability to grow earnings in an otherwise “growth-less” economy. That benefited a handful of growth companies (particularly in the fast-paced technology sector) with investors showing little concern about skyrocketing valuations.

2021 is set up to be the start of a dramatically different environment from the past two decades. The Federal Reserve projects GDP growth of 6.5% for the year.2 The OECD anticipates a 6.6% growth rate.3 Some analysts see it going even higher.

There are a number of encouraging signs supporting this thesis. One is that the job market is picking up. More than 900,000 new jobs were created in March, one of the best monthly numbers in recent history. There is significant pent-up demand for goods and services, which will encourage companies to ramp up production. In March alone, the important Institute of Supply Management index of factory activity enjoyed its biggest jump in 37 years.4 Three major government stimulus initiatives in the past year have injected more than $6 trillion into the economy, including multiple direct payments to a large percentage of Americans. That’s more than what the government spent (on an inflation-adjusted basis) on every war from World War I until the Vietnam War, combined.5

In addition, many Americans are in a stronger financial position themselves. The M-2 money stock (which is relatively liquid savings by Americans) has grown by $4.3 trillion over the past year (from Feb. 2020 to Feb. 2021). According to data from the Federal Reserve, U.S. households accumulated an additional $12 trillion in wealth in 2020. This includes the benefit of rising stock prices and home values.6 The environment also contributed to investor bullishness. In the five-month period from November through March, more money was invested into global equity funds than in the previous 12 years combined.7 It reflects a growing confidence in the strength of the economy, which supports rising interest rates… and is favorable for value stocks.

Why rising interest rates support the rotation? It’s basic math

A stronger economy, fueled by pent-up demand, massive government stimulus and an accommodative Fed, opens the door to a more inflationary environment. The expectation that this will occur may explain the rather dramatic rise in interest rates in recent times. The yield on the 10-year U.S. Treasury note, which lingered near historic lows of 0.6% in the middle of 2020, shot up to more than 1.7% by the end of the first quarter, 2021.

This is still incredibly low on an historical basis, but it is a reasonable assumption that if the economy continues to grow, interest rates could climb higher still.

Rising interest rates are likely to take a toll on expensively priced growth stocks. It comes down to basic math. Investors assess the present value of a stock by discounting future cash flows generated by the business. Interest rates play a key role in calculating the discount rate, along with other company-specific factors. When interest rates are below one percent, as was the case recently, it is easier to inflate the present value of stocks based on future earnings expectations. When interest rates start moving higher as they have been, anticipated future cash flows are worth less when evaluating the present value of an investment.

This is a major concern for growth stocks that have seen prices rise dramatically based on the promise of cash flows far into the future, as current earnings alone don’t justify their stock prices. By contrast, stocks of established companies that have not fully participated in the recent bull market are priced based on their ongoing earnings. It is reasonable to expect that as the economy gains steam, earnings will grow and that will be reflected in rising stock prices. Rather than focus their portfolios on a limited number of companies growing in a “growth-less” economy as was the case earlier, now we should see the benefits of economic growth felt among an expanded universe of companies.

Slow and steady still wins the race

The frenzied activity that marked the extreme instances of speculation that we’ve seen in recent months bears little resemblance to actual investing. Our clients know that we do not treat investing as a game. We respect the fact that you’ve worked a lifetime accumulating assets and you expect us to treat your money accordingly. Investors must recognize that one of the keys to successful wealth accumulation is quite simply to avoid large losses. Although many don’t realize it, minimizing losses typically goes much further toward achieving investment objectives than generating outsized gains. That’s why truly understanding an investment and paying the right price makes such a difference. Successful investing is not a game, but often, on a day-to-day basis, a boring pursuit that requires dedication and fastidiousness.

We’ve reached a point when our country’s economy is reopening, the federal government is injecting record stimulus into it and the Federal Reserve appears willing to continue adding liquidity even at the risk of higher inflation. Investors are best served focusing on traditional value opportunities that are apparent in today’s market. They don’t need to play the financial equivalent of “global thermonuclear war” to succeed. A good rule of thumb to remember as new, distracting opportunities arise inviting you to speculate with your money is this - “the only winning move is not to play.”

~MPMG

1 Based on annual Gross Domestic Product data from U.S. Bureau of Economic Analysis.

2 Fitzgerald, Maggie, “Here’s where the Federal Reserve sees interest rates, the economy and inflation going,” cnbc.com, March 17, 2021.

3 OECD Economic Outlook, Interim Report, “Strengthening the recovery: The need for speed,” March 2021.

4 Mutikani, Lucia, “U.S. manufacturing sector index races to 37-year high in March: ISM,” Reuters.com, April 1, 2021.

5 O’Brien, Timothy and Kaissar, Nir, “Covid Relief Bigger Than World War II Budget? Sounds Right,” Bloomberg.com, March 11, 2021.

6 Klein, Matthew, “Americans Got Richer in 2020. Here Are 5 Charts Showing Who Benefited–and How,” Barron’s, March 31, 2021.

7 Cox, Jeff, “Investors have put more money into stocks in the last 5 months than the previous 12 years combined,” CNBC.com, April 9, 2021.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.